audit vs tax reddit

06192014 I wanted to gather opinions on the ideal industry path within Big Four CPA firms. In order to make the most money in the big 4 in either practice you need to go into a practice that is in high demand.

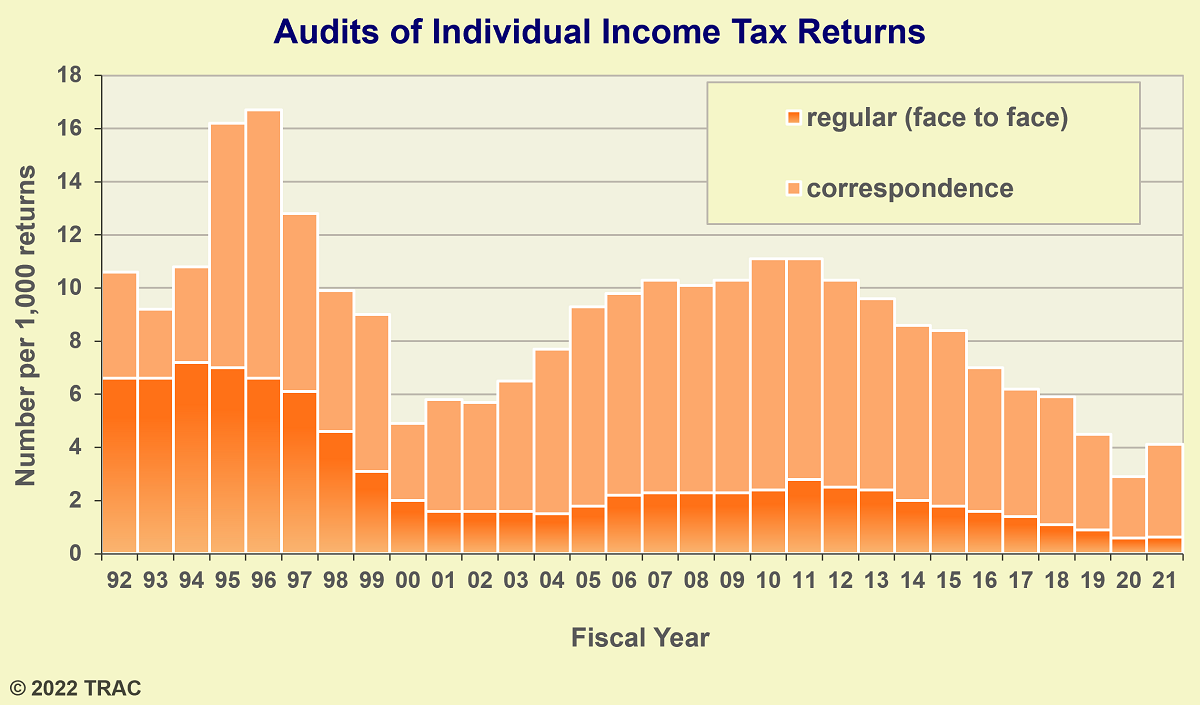

Irs Tax Audits How Likely How To Handle Them David Klasing

Consulting is highest paying and probably most interesting depending on the specific type.

. I was wondering what. The top 10 percent of workers can expect to earn 118930 per year. Deciding whether to specialize in tax or audit is a choice that college accounting majors need to make once they start their careers.

Papaya Vs Deel A Reddit User Speaks Papaya Global To contrast the audit group typically functions as a team. Audit is so much broader and lets you do more with your career. Its much more like a normal office job than audit.

To me tax requires a lot of knowledge regarding law and a bit more quantitative skills than audit this is my impression so far - as an undergraduate business student. Audit vs Tax Originally Posted. I primarily do PCI and ISO which is a bit less stringent and easy going than.

Audit more client facing people respect it in most parts of business. Its free to sign up and bid on jobs. Here are some of the differences between both options.

Lets dive into the pros and the cons of deciding between tax vs. Tax and audit oftentimes boil down to a different sort of relationship. You can do a part-time accountant gig and as compared to a barista make great hourly wages.

Tax accountants typically work individually. Tax Audit Under Section 44ab Of The Income Tax Act Swarit Advisors. They may instinctively have a sense for which discipline is the better fit with their personality and career goals.

With strong outlook and salary opportunities many business-minded individuals are interested in pursuing a career in. A Senior Associate 1. For some the choice is easy.

You and your client are on the same team. Tax pays better but kind of pigeon holes you. The key difference between tax accountants and auditors is that tax accountants specialize in helping businesses and individuals plan for minimize and file taxes while auditors ensure that accountants work is correct and following the law.

But pretty dang good. Audit vs tax reddit Thursday June 9 2022 Edit. Tax has far fewer exit opportunities than audit the longer you stay in tax the harder it is to take on non-tax roles without a large pay cut.

Auditors work with clients from day one where as tax staff might not see clients for the first one of two tax seasons. Wider range of client-oriented work. Depends on the framework your using for IT audit.

Audit entry pays less than tax but allows for far more exit opportunities since you arent as niche youre exposed. Or their internships have given them. Like the other commenter said make sure youre 100 set on tax because its hard to escape once you go this route.

You can own a CPA firm or be a partner in one and make well into the top 1 income. That being said busy season isnt horrible although it usually starts over the summer for 1231 clients which kind of sucks. Salaries in the accounting field are attractive as well with the median annual wage for accountants and auditors at 67190.

Audit is lowest paying but is a solidstable path to a good career. Tax accountants usually get paid more than auditors at least starting out. Legally minimize tax obligation.

Independent work while the audit department works on a team tax professionals have more opportunity for independent work. The key difference between tax accountants and auditors is that tax accountants specialize in helping businesses and individuals plan for minimize and file taxes while auditors ensure that accountants work is correct and following the law. Diversified industry experience to sell if youre looking for an industry exit strategy.

Im not a fan of SOX ITGC audit or SOC. Audit on the other hand. Additionally the need for tax accountants will only go up if tax reform gets passed.

Tax accountants influence business practices cash flow management and how businesses report their. Big Four Accounting. How I Chose Tax vs.

On the audit side there is a stark contrast. Search for jobs related to Tax vs audit accounting reddit or hire on the worlds largest freelancing marketplace with 19m jobs. You will need to be comfortable with a degree of friction or differing opinions with your client.

Starting salary is similar. Fast turn-around while audits may drag out for weeks or months tax. Your typical exit is F500 or IRS otherwise youre stuck in public accounting.

If you do 2-3 years of audit at b4 you can get hired just about anywhere. Stunning Auditing Policy Template Internal Audit Report Template Best Templates How To Get Your Annual Audit In China Started And Why It Is Important. Tax will pigeon hole you the more time you spend in tax the more you become the tax person no one will consider you for anything outside of tax the more time you spend in it.

Audit vs Tax I just got an internship offer from a big four company and now its time to start thinking about whether to go into audit or tax. A Senior Associate 2. Tax you can get hired into any tax department but audit will give you.

Where as auditors work in teams. On the tax side the objective is aligned. Often longer and more intense busy seasons than tax.

Its got its negatives but overall its enjoyable. Exposure to a wider range of industry financial reporting. Wide variety of WLB choices.

Tax might be a little higher since its more specialized. While there is always someone available for questions if needed if you prefer to work on projects on your own then tax might be a better fit. It would be very hard to answer all those questions in a subreddit.

In conclusion tax accountants make more money than auditors on average and in my experience they earn about 10 more.

Top 15 Red Flags Triggering An Irs Tax Audit Thestreet

What Happens During A Tax Audit

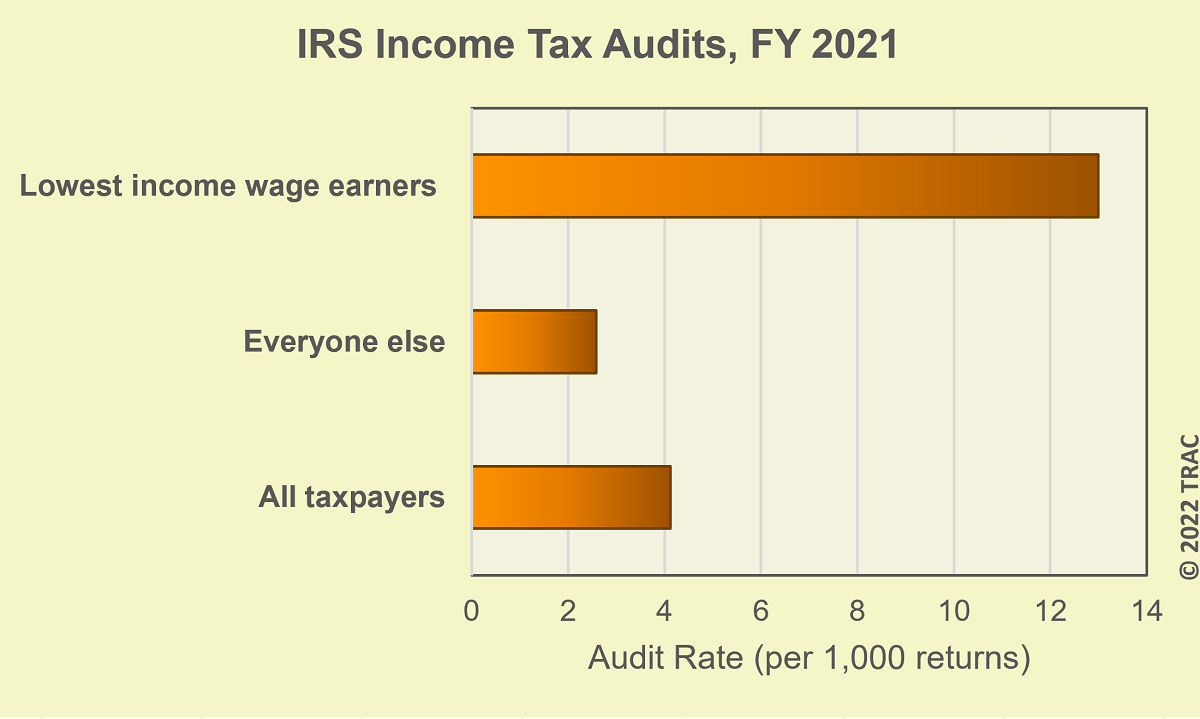

Irs Audits Poorest Families At Five Times The Rate For Everyone Else

Irs Audits Poorest Families At Five Times The Rate For Everyone Else

Common Irs Audit Triggers Bloomberg Tax

Workplace Auditing Tax Process And Accounting

Tax Or Audit That Is The Public Accounting Question

Irs Audit Penalties And Consequences Polston Tax

I Survived An Irs Audit By Representing Myself Got This Reply Letter Yesterday R Pics

Irs Tax Audits How Likely How To Handle Them David Klasing

Will A State Audit Trigger A Federal Tax Audit Community Tax

Tax Vs Audit A Q A With Bs In Accounting Program Director John Barden Jindal Home

Irs Audits Poorest Families At Five Times The Rate For Everyone Else

Irs Tax Audits How Likely How To Handle Them David Klasing

Auditing Tax Accounting Concepts

I Was Audited By The Irs And The Red Flags To Avoid An Irs Audit

:max_bytes(150000):strip_icc()/SalesforceSocialAudit2017-5c856a1946e0fb0001a0be84.jpg)